[Date Prev] | [Thread Prev] | [Thread Next] | [Date Next] -- [Date Index] | [Thread Index] | [List Home]

Subject: Re: [ubl-psc] Groups - UBL/Tax XML Planning Meeting added

|

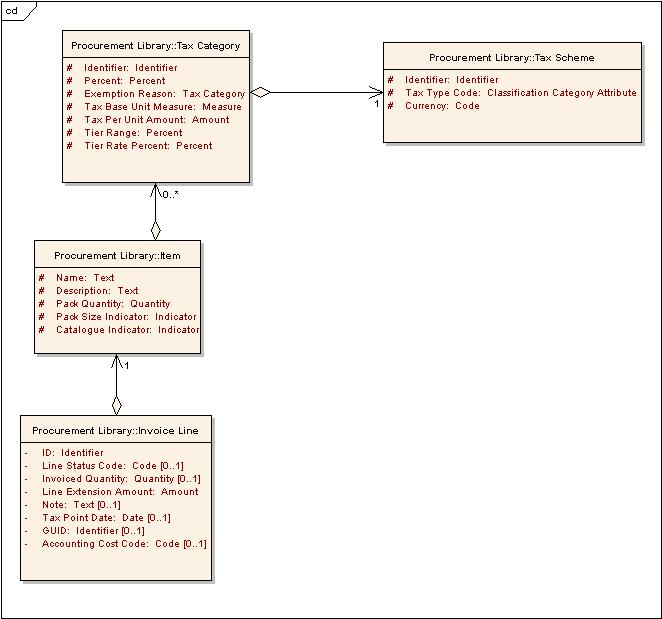

In preparation for this meeting I thought it might be useful to revisit

the question of UBL's Tax Category and the Tax Item Category requested

by TaxXML. My suggestion is that we leave the current UBL Tax Category to be the categorization of the tax to be applied. This is defined as "the category of the tax and, by implication, the tax rate or other tax calculation that applies. This may be only indicative, the actual rate of other calculation attributed to an item is dependent on the tax jurisdiction." For example, "ZeroRatedGoods" "NotTaxable" "Standard Rate" are tax categories. However, this is not currently used correctly. In UBL 1.0 we have Tax Category associated with Item. In fact, it should be associated with Invoice Line. That is, the Tax Category (as we define it) is dependent on the transaction NOT the Item. The same Item (e.g. a computer) can attract different Tax Categories depending on who buys it and what the circumstances of the sale are. So it should be Invoice Line -> Tax Category. I suspect this is what led to the confusion. our "Tax Category" was neither one thing or the other. So, I also propose we introduce a "Tax Classification" ABIE (that is the equivalent of the Tax XML Item Tax Category). (I suggest changing the TaxXML term "category" to "classification" to line up with other classification schemes proposed for UBL 2.0.) This would be defined as "A classification of items that may be used to identify items from the perspective of determining tax liability." For example, items classified as clothing may be subject to a standard tax rate in a particular jurisdiction, however a sub classification of clothing, such as children’s clothing may be nontaxable or zero-rated, while another sub classification such as luxury clothing, for example furs, could have a surcharge or higher tax rate. It is this Tax Classification that should be associated with an Item. The classification is always the same for this Item regardless of the transactions it participates in. In this way Item -> Tax Classification should replace Item->Tax Category. As far as what Tax Classification should look like, its only identified property (from the TaxXML paper) is a Name but it also has an association with Tax Category to set default tax rates for a given Tax Scheme. From the example given these classifcation are hierarchical (has sub-classifications) as well. I have drafted a rough diagram of what the current and proposed models would look like. (see attached). Perhaps we can discuss these on the call Wednesday. swebb@gefeg.com wrote: Due to the regularly scheduled UBL call at 16:00 UTC, and a calendar mixup on my part, this meeting will need to conclude promptly at 15:30 UTC/10:30 EST/7:30 PST. -- Ms. Sylvia Webb UBL/Tax XML Planning Meeting has been added by Ms. Sylvia Webb Date: Wednesday, 09 November 2005 Time: 03:00pm - 03:30pm GMT Event Description: ############################################# STANDING INFORMATION FOR UBL CONFERENCE CALLS U.S. domestic toll-free number: (866)839-8145 Int. access/caller paid number: (865)524-6352 Access code: 5705229 ############################################# Agenda: Discuss how UBL PSC and Tax XML can collaborate for UBL 2.0 content. Minutes: View event details: http://www.oasis-open.org/apps/org/workgroup/ubl-psc/event.php?event_id=8904 PLEASE NOTE: If the above link does not work for you, your email application may be breaking the link into two pieces. You may be able to copy and paste the entire link address into the address field of your web browser. -- regards tim mcgrath phone: +618 93352228 postal: po box 1289 fremantle western australia 6160 DOCUMENT ENGINEERING: Analyzing and Designing Documents for Business Informatics and Web Services http://www.docengineering.com/ |

[Date Prev] | [Thread Prev] | [Thread Next] | [Date Next] -- [Date Index] | [Thread Index] | [List Home]